Easy payroll calculator

Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

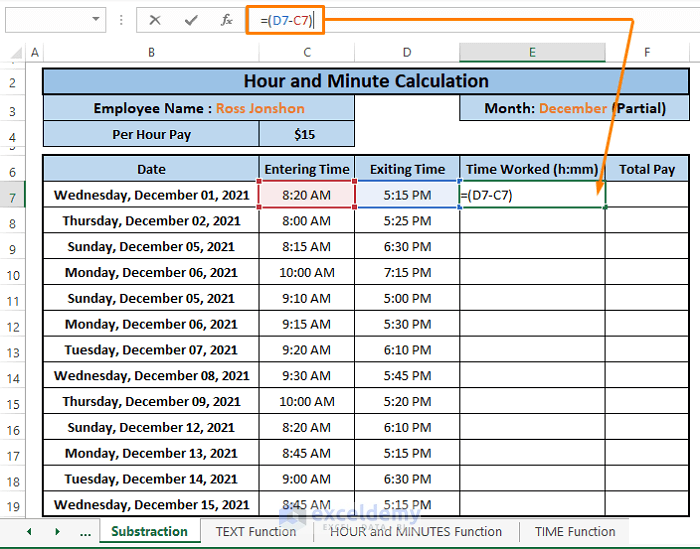

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

Ad Top Quality Payroll Calculators Ranked By Customer Satisfaction and Expert Reviews.

. Computes federal and state tax withholding for. Learn More About Streamlining Your Employee Expense Reimbursement Process. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries.

Taxes Paid Filed - 100 Guarantee. Ad Process Payroll Faster Easier With ADP Payroll. Boost Your Business Productivity With The Latest Simple Smart Payroll Systems.

Heres a step-by-step guide to walk you through. This calculator is always up to date and conforms to official Australian Tax Office. Payroll calculator tools to help.

Choose Tax Year and State Tax Year for Federal W-4 Information Filing Status Children under Age 17 qualify for child tax credit Other Dependents Check if you. Its so easy to. Ad An End-To-End Accounting Solution To Help Law Firms Keep Their Finances On Track.

Determine the differences between an items list price and its final selling price. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Get Started With ADP Payroll.

Start A Free Trial Today. Supports hourly salary income and multiple pay frequencies. Ad Compare This Years Top 5 Free Payroll Software.

Ad See How MT Payroll Services Can Help Streamline And Grow Your Business. Fast easy accurate payroll and tax so you can. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Calculate how tax changes will affect your pocket. 16 hours agoTo qualify for this forgiveness program you must have federal student loans and meet specific income requirements. Pay 0 upfront all monthly.

Federal Salary Paycheck Calculator. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Total Earning Salary.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Compare the Best Now. Decide how much you pay upfront and per month.

Sage Income Tax Calculator. Pay calculator Use this calculator to quickly estimate how much tax you will need to pay on your income. Discover ADP Payroll Benefits Insurance Time Talent HR More.

All other pay frequency inputs are assumed to. Find 10 Best Payroll Services Systems 2022. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use these calculator tools to help you determine the impact of changing your payroll deductions. The income limits are based on your adjusted gross.

Subtract the sales price from the list price to get the. Ad Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You. Employers can use it to calculate net pay and figure out how.

Manage Your Law Firm With One Easy To Use Platform. Pay more upfront less monthly. Free Unbiased Reviews Top Picks.

Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Number of Qualifying Children under Age 17 Number of Allowances State W4 Pre-tax. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into.

Get Instant Recommendations Trusted Reviews. You can Calculate a Discount through the following steps. Small Business Payroll 1-49 Employees.

See 2022s Top 10 Payroll Calculators. Get Started With ADP Payroll. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

Fast easy accurate payroll and tax so you can save time and money. When using the Paycheck or Hourly Paycheck Calculator you can enter your up-to-the-date. Ad Process Payroll Faster Easier With ADP Payroll.

For example if you earn 2000week your annual income is calculated by. Ad Easy To Run Payroll Get Set Up Running in Minutes. Next divide this number from the annual salary.

Ad The New Year is the Best Time to Switch to a New Payroll Provider. Affordable Easy-to-Use Try Now. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

State Pay Cycle.

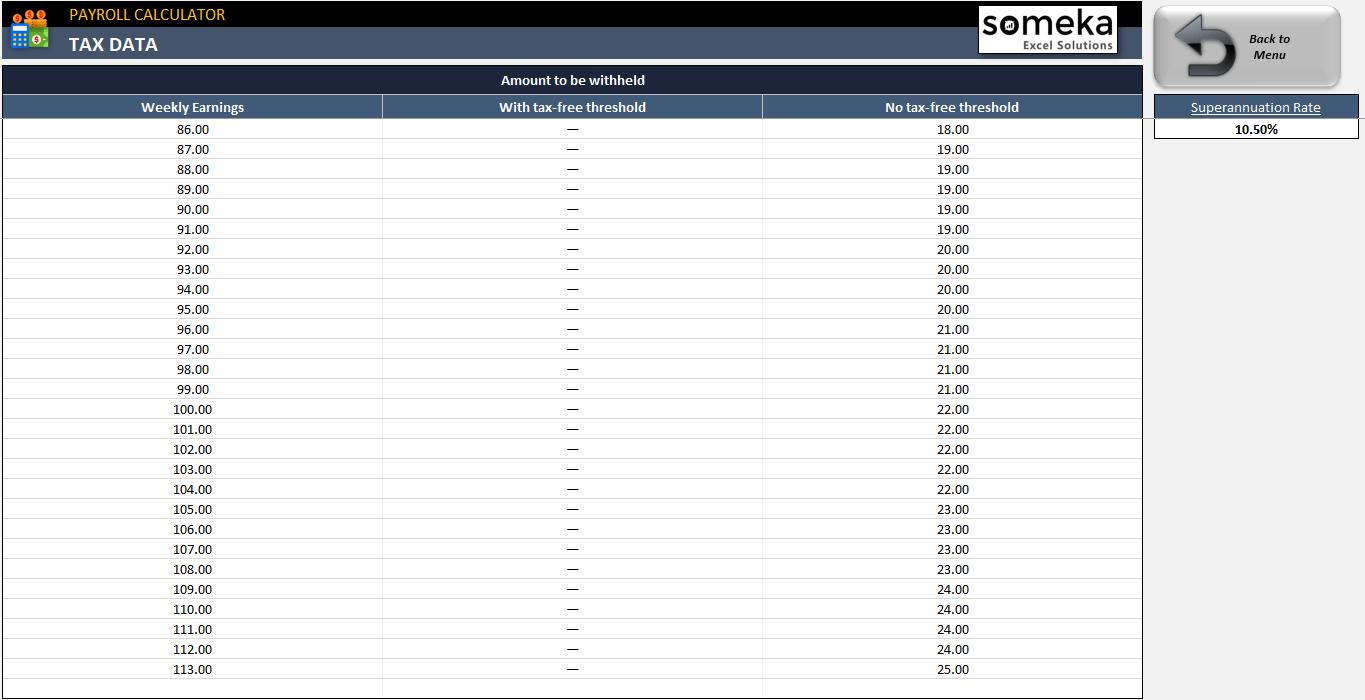

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

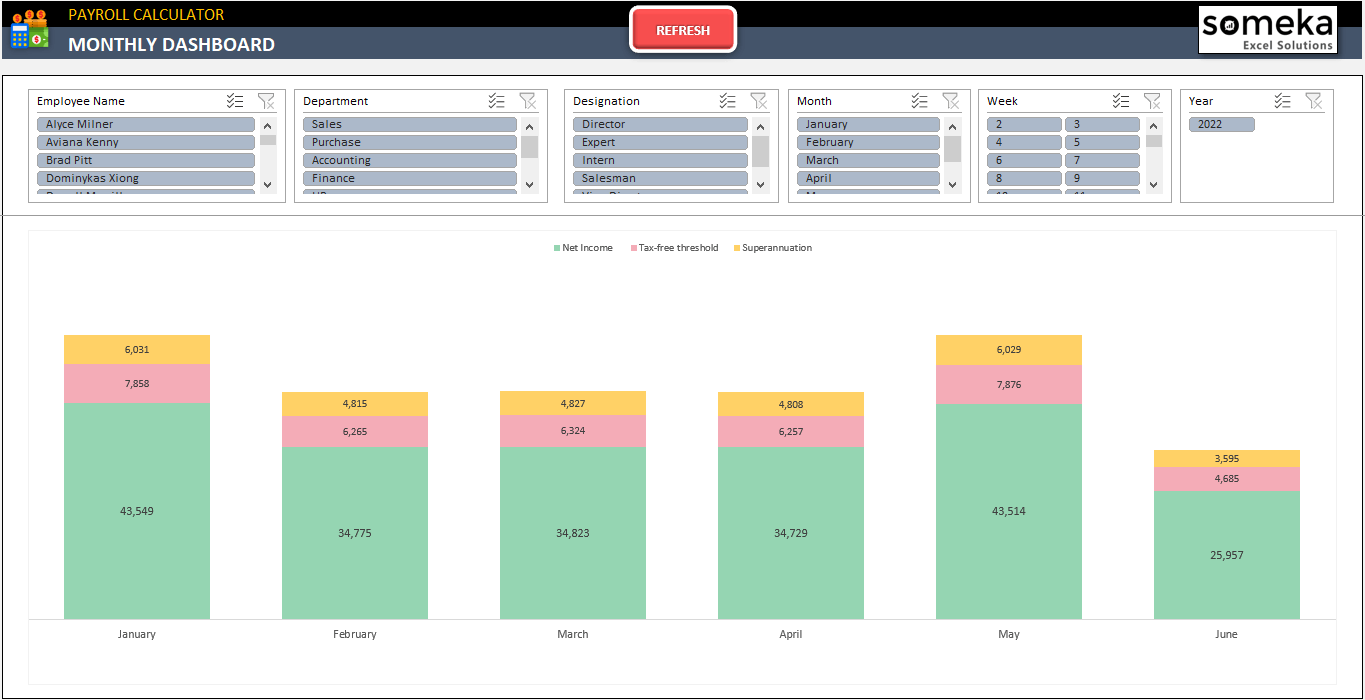

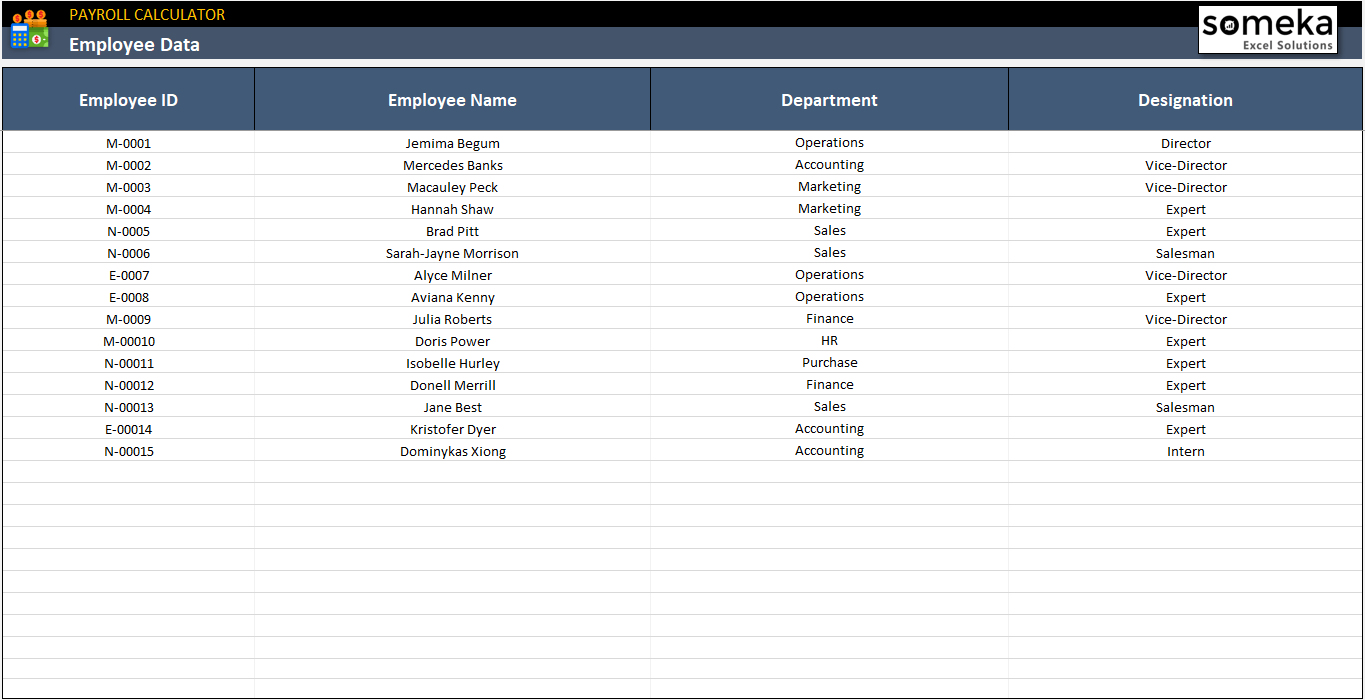

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

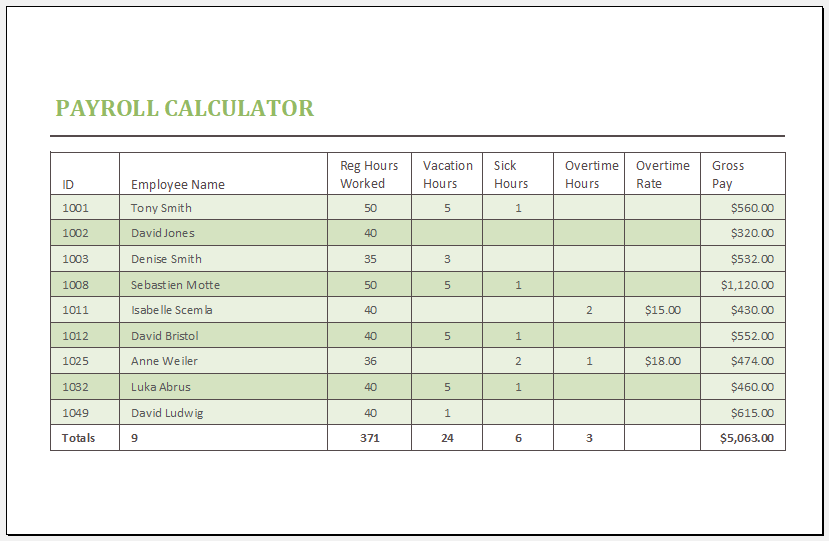

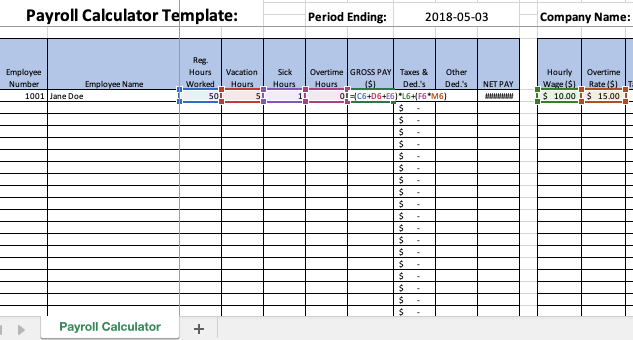

Payroll Calculator Template For Ms Excel Excel Templates

How To Calculate Payroll For Hourly Employees Sling

How To Calculate Payroll Taxes Methods Examples More

Excel Payroll Formulas Includes Free Excel Payroll Template

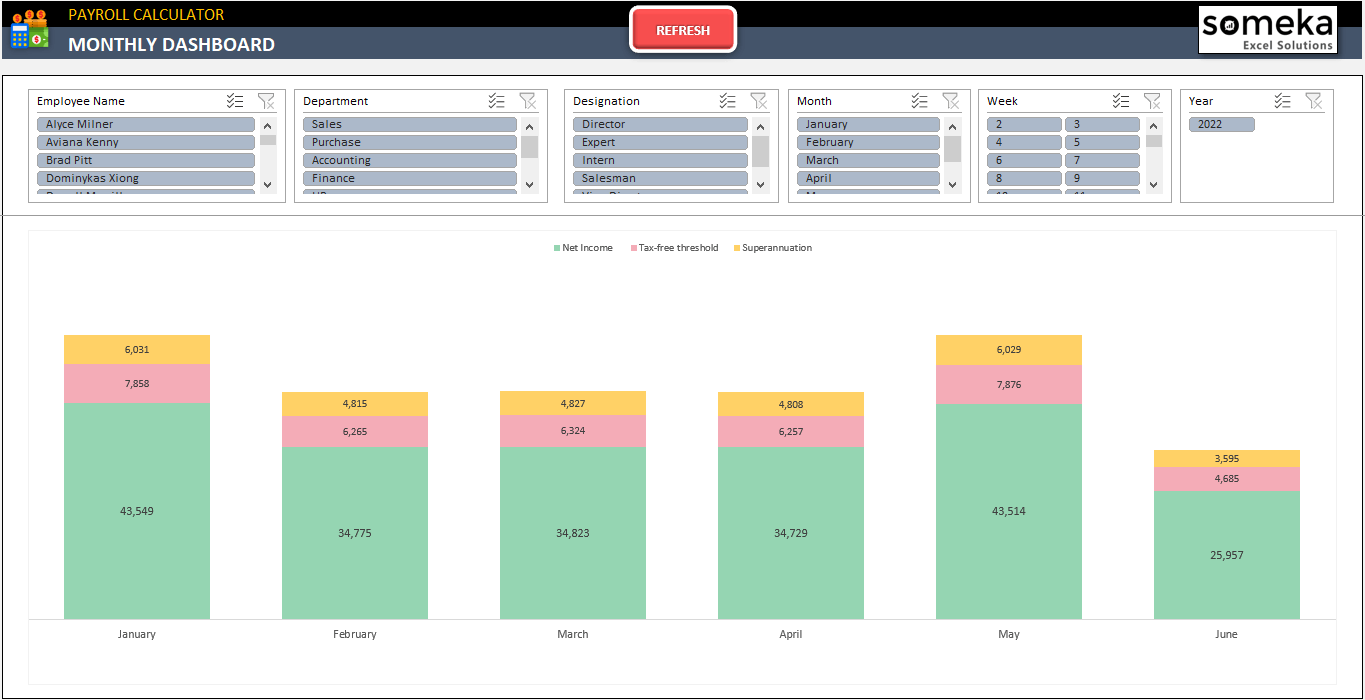

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

15 Free Payroll Templates Smartsheet

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Payroll Calculator With Pay Stubs For Excel

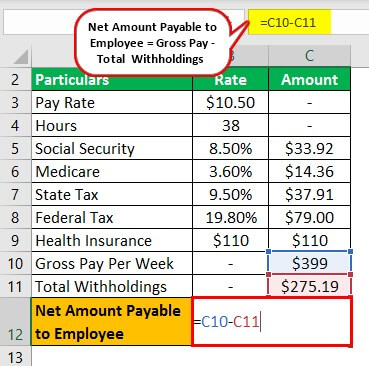

Payroll Formula Step By Step Calculation With Examples

Payroll Calculator Free Employee Payroll Template For Excel

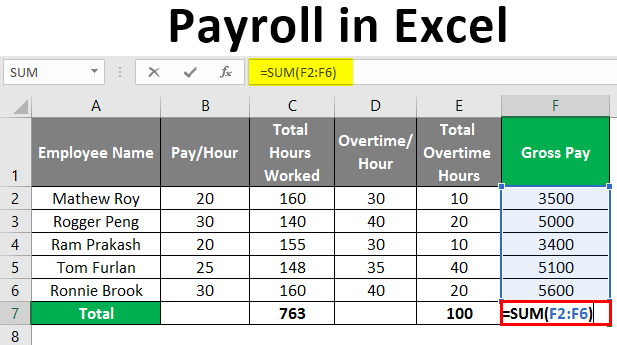

Payroll In Excel How To Create Payroll In Excel With Steps

Payroll Calculator Free Employee Payroll Template For Excel